Forecasting

Applying a forecasting algorithm directly to currency pairs runs into an immediate problem of self-consistency. Consider an example where we calculate separate forecasts on the pairs GBPUSD, USDCAD and GBPCAD. It's unlikely that the calculating forecasts will follow the chain rule: GBPCAD = GBPUSD x USDCAD. This represents an obvious problem which we can try to overcome here.

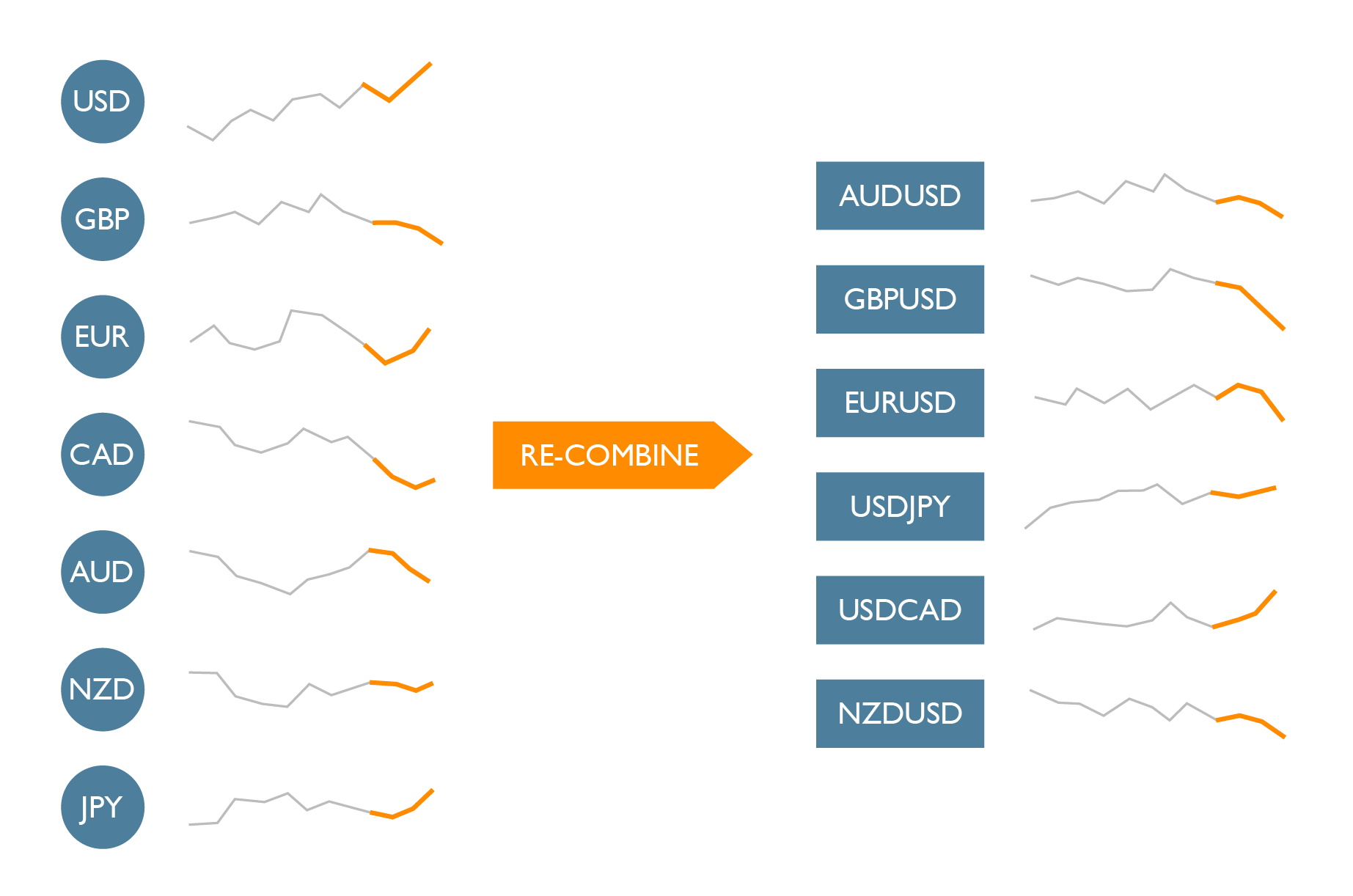

The idea is to only apply forecasting algorithms on our calculated index signals for individual currencies. With the 7 index forecasts calculated, we can then recombine them to create forecasts for any of the 21 pairs. The algorithm guarantees that the self-consistency of the chain rule is maintained, and so our forecasts will be consistent in this way.

Forecasting on any kind of market data is very challenging due to the high frequency movements in the market. Not only is the market data non-stationary in terms of variance, but the oscillation components cannot be expected to have constant frequencies.

The tool we provide makes use of the forecasting Singular Spectrum Analysis algorithm. The window of previous data used is 10 weeks of hourly price points. Our research suggests that a period this long is needed to stabilise the calculation with regard to high frequency movements. Having said that, it is still common for the algorithm to struggle when sudden price movements occur.

This is an area of active research at Treeline. The SSA algorithm comes with many variations and extra techniques to validate forecasts. We will continue to develop the offering over time.

*** IMPORTANT: Forecasts alone are not usable in a trading system. It simply doesn't work that way and our terms of service make it clear that they are not intended for this use. They are a research tool to potentially help understand the Forex market, and are highly speculative. There is no published research to show their reliability in predicting future market movements.

Back to the algorithm