Underlying Unified Index Algorithm

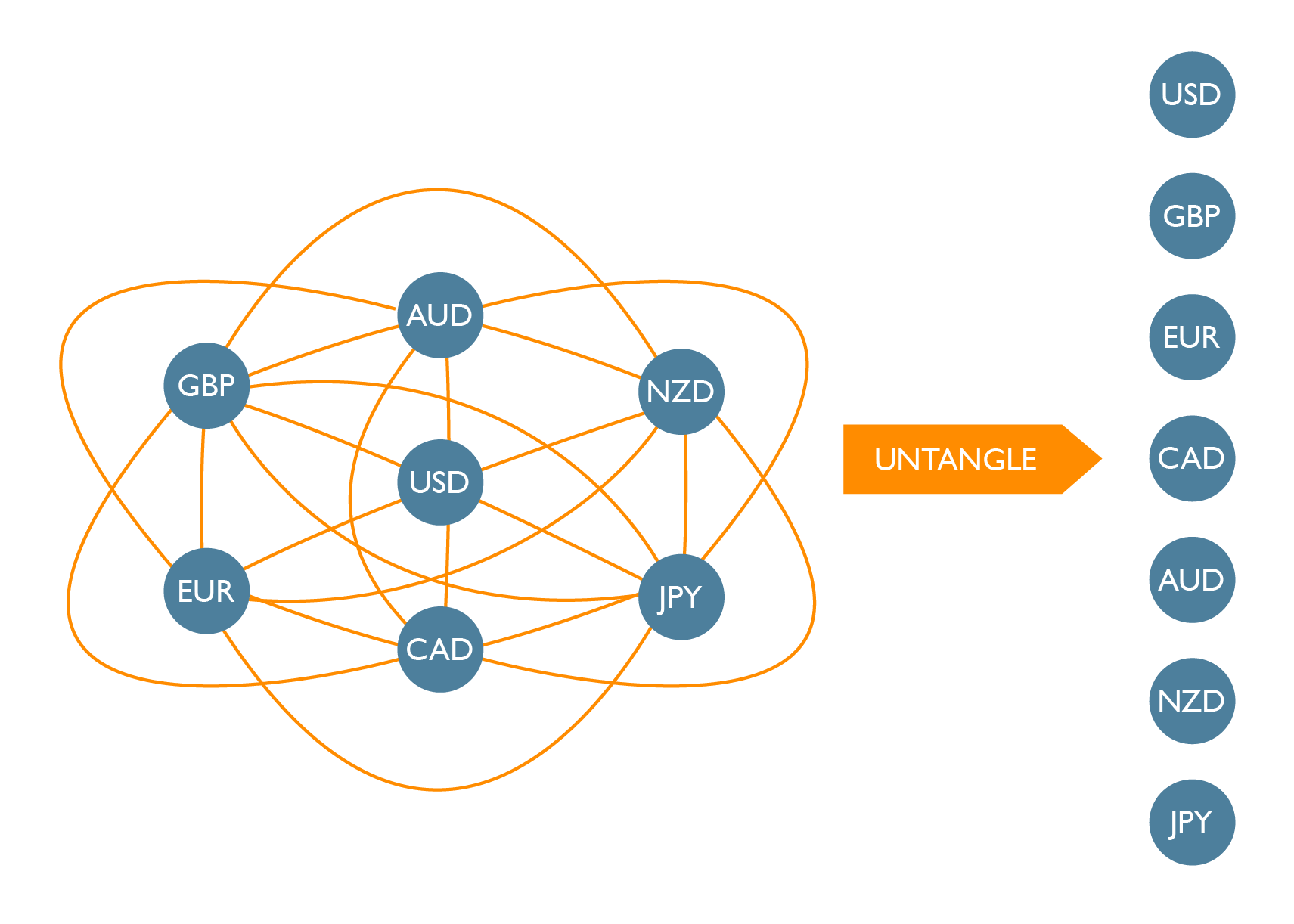

Forex currency pairs are not isolated instruments to trade in the same way that a stock is. A given pair represents the relationship between two distinct currencies, adding extra complexity to the valuation. When one attempts to assess the current state of the Forex market, a trader might first look through the major pairs, EURUSD, GBPUSD, AUDUSD, USDJPY and so on. At some point we might start to try and isolate which individual currencies are causing movements in the prices. And so begins a complex, error-prone untangling of the pairs. To find a measure of each individual currency’s impact on price movements, Forex traders can appeal to publicly available indexes such as the USDX. This informs the relative strength of the US dollar against a basket of other currencies. Likewise, the BXY provides the relative performance of the British Pound against other currencies. ASDX for the Australian dollar, and so on.

Each of these indexes is calculated using some arbitrarily weighted basket of other currencies, and as a whole they do not form a self-consistent group of values. More specifically, from one point in time to the next, it would not be possible to take this set of public index value changes, and recover the actual currency pair price changes. To what extent can these indexes really help with analysis of the Forex markets? Possibly in a qualitative sense they have their uses, but in a quantitative sense it seems unclear.

The TreelineFX Mesh Optimization algorithm seeks to provide traders and analysts with a set of self-consistent, individual currency indexes, calculated on demand as price movements occur in the Forex market. These indexes are fully reversible, in the sense that we can move from real market price movements, to movements in these calculated indexes, and then back again without any information loss.

If we consider the 7 major countries, USD, EUR, GBP, JPY, CAD, AUD and NZD, there are 21 cross-pairs in total. By moving our analysis into this indexed space, we can instead deal with 7 signals to analyze. In a sense it can be considered a factorization of the 21 currency pairs. As expected, we typically find that the 7 individual signals have higher entropy and are more information dense than currency pair signals themselves.

Intellectual Property

Our underlying technology has patent pending status. For licensing enquiries, please email us at licensing@treelinefx.com.

While the underlying algorithm is quite complex in nature, the implementation is readily converted between languages such as Swift, Java, C, PHP etc... The calculation time for each price point is in the order of milliseconds and does not require specialist hardware.

Applications

We believe unified currency indexes have the potential to completely rethink the way we approach technical Forex analysis. Any tool we previously used to assess the market can be applied to these index charts, as well as the pairs we traditionally apply the tools to. Instead of one data point, now we have 3, one for the pair and one for each underlying currency index. The question of how to combine these data points is wide open and potentially a game-changed for analysts.

At this time our offering provides two powerful applications of the technology: